生意编号40842

最近更新2026年02月20日

9人已浏览

Cash-Flowing & Profitable E-Commerce Acquisitions Fully Managed

牛车水网店

转让费$10-20万

生意转让

寻求投资

合作伙伴

Trendhijacking

我要咨询

生意概述

- 物业类型 在家经营

- 物业面积 一

- 每月租金 一

- 房租押金 一

- 月营业额 一

- 欠款负债 一

- 月毛利润 一

- 月净利润 一

- 库 存 一

- 设施设备 一

- 应付帐款 一

- 应收账款 一

- 卖家职责 全职

- 员工人数 9

- 成立时间 2022

- 发布来源 个人

转让原因

Personal reasons

生意详情

Another month. Another set of acquisition listings. Same pattern as before.

The metrics look reasonable.

The margin structure seems sound.

But something feels off, and you can't quite identify what it is until months into ownership when it's too late to matter.

That's the typical path for solo acquisition hunters.

The successful ones operate differently.

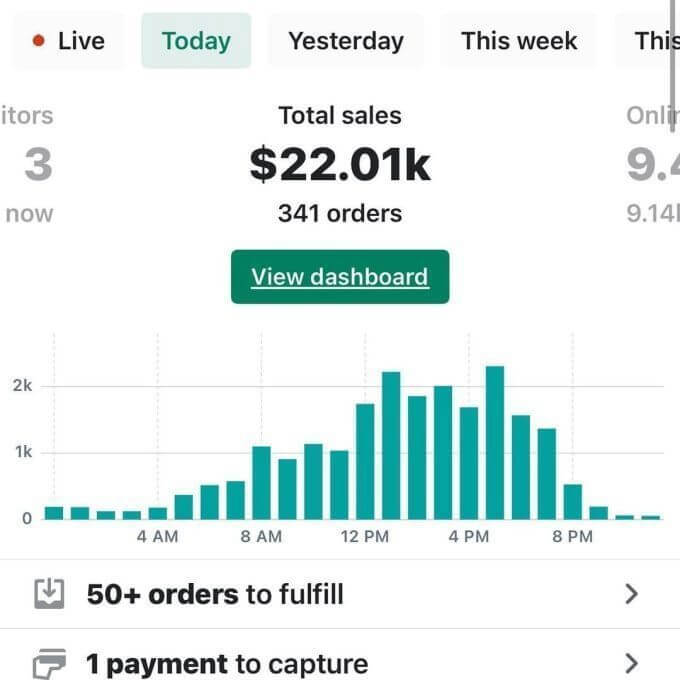

Over four years, we've analyzed 2,000+ acquisition attempts.

We've mapped exactly where investors compound wealth and where they lose money before day one through poor negotiation, incomplete due diligence, and inadequate operational planning.

The pattern is predictable and avoidable.

The Smart Acquisition Program was built on this pattern analysis.

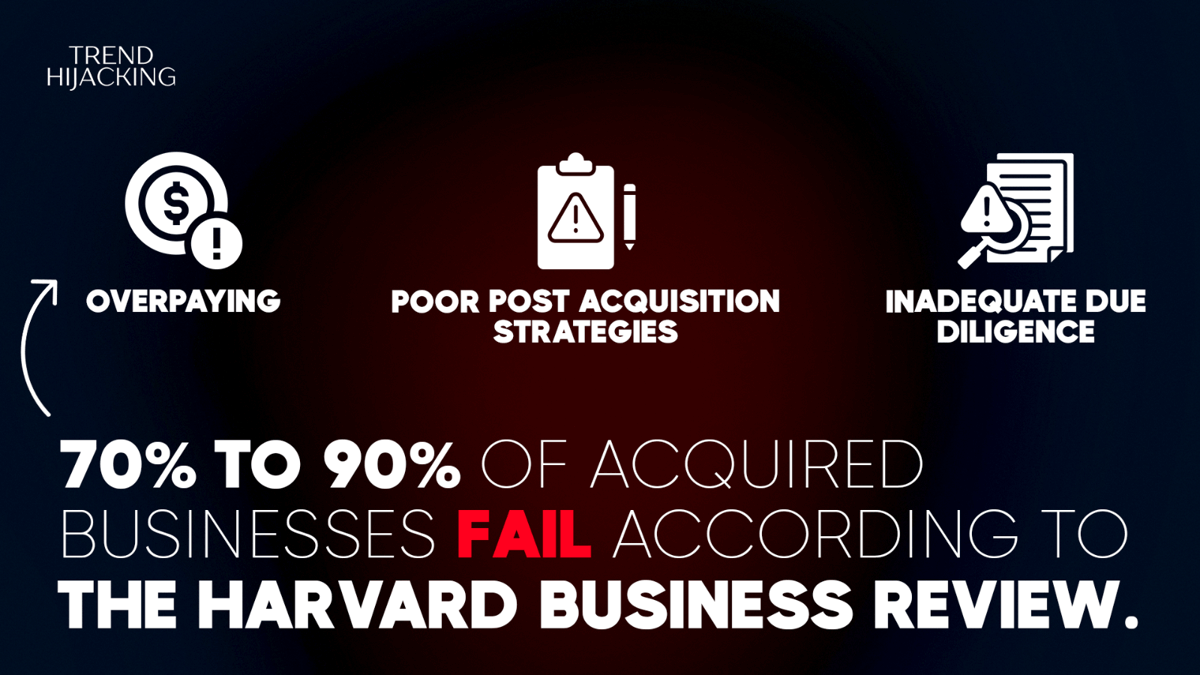

We help you acquire a high cashflow ecommerce business at below market value, guide you post acquisition, and give you our proprietary framework so your business is primed to generate 6 figures in monthly returns,

And sell for 6 to 8 figures…

Here's what this looks like:

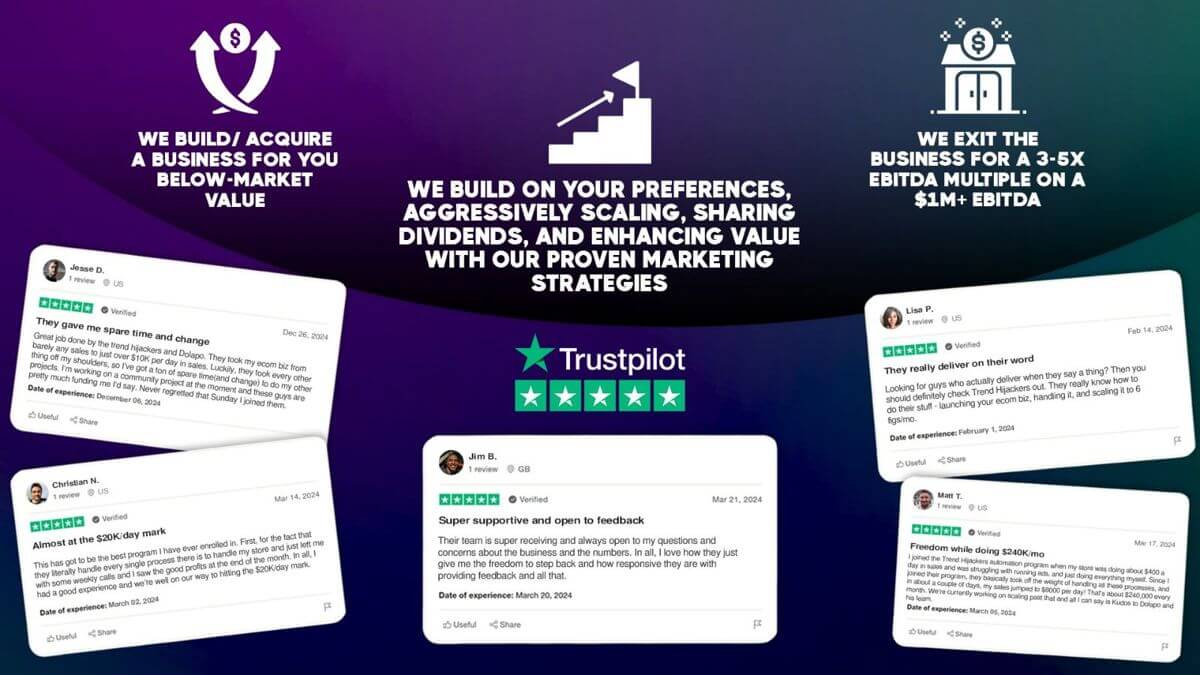

We source from 2,340+ vetted seller networks.

We show you only the opportunities that fit your acquisition and capital criteria.

We negotiate 15-40% below asking price, securing instant equity at closing. Our clients averaged £69,000 in savings last year.

We architect your lean operations model: remote team and 4-5 hour weekly involvement.

We provide 30 days of post-acquisition strategy to prevent costly first year mistakes.

And if you choose to partner with us, you still keep 100% ownership.

Unlike what most advisories or agencies that take retainers + equity cuts

We juts take a flat fee. No equity. No percentage cuts. No hidden costs.

14-day free trial: Pipeline access, live walkthroughs, M&A consultation, zero upfront commitment.

The investors who succeed with us need leverage they can't build alone.

They need vetted deals. They need a proven framework.

If you're seeking passive income with unrealistic expectations, this isn't it.

But if you're ready to apply professional acquisition methodology to your capital book a 30-minute consultation.

No pitch. No pressure. Just a direct conversation about your strategy and our pipeline.

The metrics look reasonable.

The margin structure seems sound.

But something feels off, and you can't quite identify what it is until months into ownership when it's too late to matter.

That's the typical path for solo acquisition hunters.

The successful ones operate differently.

Over four years, we've analyzed 2,000+ acquisition attempts.

We've mapped exactly where investors compound wealth and where they lose money before day one through poor negotiation, incomplete due diligence, and inadequate operational planning.

The pattern is predictable and avoidable.

The Smart Acquisition Program was built on this pattern analysis.

We help you acquire a high cashflow ecommerce business at below market value, guide you post acquisition, and give you our proprietary framework so your business is primed to generate 6 figures in monthly returns,

And sell for 6 to 8 figures…

Here's what this looks like:

We source from 2,340+ vetted seller networks.

We show you only the opportunities that fit your acquisition and capital criteria.

We negotiate 15-40% below asking price, securing instant equity at closing. Our clients averaged £69,000 in savings last year.

We architect your lean operations model: remote team and 4-5 hour weekly involvement.

We provide 30 days of post-acquisition strategy to prevent costly first year mistakes.

And if you choose to partner with us, you still keep 100% ownership.

Unlike what most advisories or agencies that take retainers + equity cuts

We juts take a flat fee. No equity. No percentage cuts. No hidden costs.

14-day free trial: Pipeline access, live walkthroughs, M&A consultation, zero upfront commitment.

The investors who succeed with us need leverage they can't build alone.

They need vetted deals. They need a proven framework.

If you're seeking passive income with unrealistic expectations, this isn't it.

But if you're ready to apply professional acquisition methodology to your capital book a 30-minute consultation.

No pitch. No pressure. Just a direct conversation about your strategy and our pipeline.

商业运作

Unlike the conventional route of acquiring a traditional business, our model requires minimal upfront investments, establishing itself as the most competitive path for swift and risk-free growth. Allow us to manage the complexities while you effortlessly enjoy the rewards, highlighting why our business model holds a distinct and superior advantage over the traditional purchase approach.

市场竞争

After the acquisition, we focus on accelerating your e-commerce business growth by enhancing brand identity and scaling operations. This includes refining brand positioning, implementing cutting-edge marketing strategies, and creating a compelling digital presence to connect with the target audience. Operational streamlining ensures efficiency by optimizing supply chains, automating workflows, and leveraging reliable fulfillment networks. Growth is driven by analyzing market data to identify trends, refine strategies, and optimize advertising for high ROI. Expansion efforts tap into new markets and product categories while preparing the business for an exit by positioning it as a lucrative, scalable asset. This holistic approach ensures long-term success and maximized value for Partners.

扩张潜力

是的, 生意是加盟品牌。

加盟品牌

Enroll in our Acquire and Scale Program to access unparalleled automated support. Imagine a devoted team managing everything operation, including but not limited to Acquisition Research, Due Diligence, Negotiation, Repositioning, multi-platform ad launches, and even hiring all conducted on your behalf. We empower you to concentrate on what truly matters while we expertly navigate every aspect of your business journey.

支持培训

物业信息

是的,可搬迁至其它地方。

可否搬迁

是的,可以在家经营。

在家经营

会员专区

我要咨询

请使用英文发送留言

* 您的姓名

▼

* 手机号码

* 电子邮箱

留言详情

所有广告信息均由卖家或其代表提供。我们不对信息的准确性、完整性或真实性进行核实,也不提供任何保证或担保。任何因此而产生的纠纷、索赔或决定,均应由买卖双方自行承担和解决。了解更多 如何避免诈骗。