筛选条件

地点

▼

行业

▼

生意类型

生意转让

排序:

默认

发布日期

价格

营业额

净利润

共1611个生意转让

-

接手即可盈利

实龙岗S$10(可商) -

🔥 Rare Large-Scale Premium Preschool For Sale | ~S$3M Revenue With Strong Ebitda

市中心S$150万 -

Trophies For Corporate Awards And Liuli Collections

淡滨尼S$55万(可商) -

Car Ppf | Wrap | Solar Film | Detailing

宏茂桥S$10万(可商) -

Massage shop for takeover

实龙岗价格面议 -

Student Care/Tuition Centre For Takeover

义顺S$6.8888万(可商) -

Lowest Rental For A 667Sqft Shop! Rental 3.2K Only! 1% GTO

樟宜S$2.3万(可商) -

10+ Year Established Pet Grooming & Pet Sales Business – Profitable Turnkey Opportunity

兀兰S$60万(可商) -

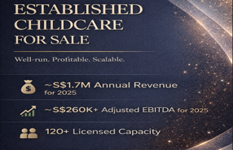

🏫 Established Profitable Childcare Near Thomson | Scalable | High Demand Catchment

市中心S$98万(可商) -

Looking For Investors To Fund A Fast Growing Food Manufacturing Business, ROI Guaranteed.

市中心S$50万 -

Coffee Hive / Kopi Korner / Cravy (Korean) Fried Chicken Franchise Opportunities

宏茂桥价格面议 -

Indoor RAS Fish Farm in Singapore – Stocked, Ready to Grow

兀兰S$18万(可商) -

注册近30年老牌家具店生意转让

乌美S$395万(可商) -

Steamboat & BBQ Restaurant For Takeover

加冷/黄埔S$8.8万(可商) -

Profitable Lubricant Wholesale & Distribution Company For Sale

裕廊东S$100-500万 -

转让饭店

牛车水价格面议 -

🇸🇬 24/7 Private Hangout Rooms In Chinatown Singapore ⭐️🌙

市中心S$7万(可商) -

Great Starter Business

加冷/黄埔S$4.5万(可商) -

$ Min.8%-12% Return Guaranteed $ 20 Years History $ Best & Rarest Opportunity You Should Not Missed

市中心S$4万 -

Multi-Award Winning Beauty Salon Central Locations

乌节路S$20-50万 -

Established Employment Agency + Job Search App For Sale ! High Margin Business !

市中心S$100-500万 -

Profitable Seeking Active Partner / Investor

勿洛RM10-20万 -

Profitable And Growing Cleaning and Defects Inspection company

市中心S$70万(可商) -

Highly Profitable Heavy Vehicle Repair Shop For Sale!

裕廊西S$400万(可商) -

Profitable Mobile Game Studio Seeking Investment For Growth With Attractive ROI

兀兰价格面议 -

🔥 RARE OPPORTUNITY – HALAL OR NON HALAL CENTRAL KITCHEN / FOOD SPACE FOR RENT 🔥

麦波申S$5-10万 -

Acquire An Established Singapore Corporate Entity (11+ Years) With Proven Revenue Track Record

市中心S$10万(可商) -

Established Pest Control Business For Sale !

市中心S$200万(可商) -

Need Investors for IPO

兀兰<S$5万 -

Amazing Opportunity - company since 2017

实龙岗价格面议 -

Seeking Strategic Partner for a Scalable F&B Venture Linked to US FoodTech

实龙岗S$10-20万 -

Vegan Cookies Business (Thai Tea Flavour)

市中心S$17.3万(可商) -

Profitable Food Distribution (FMCG) Business For Sale !

市中心S$280万 -

NO MANPOWER COST FRANCHISE BUSINESS 无人力成本加盟店

市中心S$9.5万 -

Landscaping Company For Take Over, Sales

宏茂桥S$190万(可商) -

Invest In A Sugarcane Vending Machine Franchise With Avg 4.5% Monthly Return!

市中心S$2.5万 -

Fully Set-Up SG Toy Brand | Community, Systems & Inventory Included

东海岸S$17万(可商) -

Business For Takeover | Sg-Registered Vehicle Services (Vep Assistance)

市中心S$6万(可商) -

“Established, High-Traffic Restaurant With Proven Earnings”

武吉士S$39万(可商) -

Multi-Centre Childcare Group | S$3.4M+ Revenue | Strong Ebitda With Growth Potential

市中心价格面议

-

市中心

餐饮美食

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

Cafe located in central business area for sale. Newly opened in early 2025 and tastefully renovated in an upscale mall. Fully operating with exisiting, can immediately takeover and run. Owner giving up due to other business commitments overseas. Looking for new owner/operator to takeover. PM f...生意转让寻求投资合作伙伴 -

市中心

食品贸易

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

Leading Company is a B2M distributor of fast-moving consumer products such as Frozen food, Ready-to-Eat (RTE) food products, Alcohol, Barguns and Hygiene products. The Company hold exclusive distribution rights and partnerships, including: 1) Exclusive beer draft distribution rights in Singapore, ...生意转让寻求投资合作伙伴 -

樟宜

亚洲风味餐厅

泰国餐厅

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: S$3170

Good road facing drop off point unit facing DBS looking for takeover! Pack lunch crowd daily. Please whatsapp生意转让寻求投资合作伙伴 -

市中心

职业介绍所

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

Established for over 10 years, the Company comprises a team of 7 highly experienced recruitment specialists and a well-refined service platform serving multiple industries. The Company delivers bespoke recruitment solutions tailored to client needs, offering the following services: 1. Executive Se...生意转让寻求投资合作伙伴 -

S$200万(可商)

市中心

灭虫服务

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

Well-Established BCA L2 Graded Pest Control Business for Sale Serving a Diverse Clientele: Private residences, F&B establishments, MCSTs, government agencies, town councils, and more. Key Highlights: ✅ NEA Registered – Fully compliant with regulatory standards ✅ BizSafe Star Certified – Recognized...生意转让寻求投资合作伙伴 -

市中心

汽修店

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: S$5789

This opportunity involves the acquisition of an established automotive workshop in Singapore with a strong reputation for quality workmanship and reliable service. The business has built long-standing relationships with government agencies and corporate fleet clients and has maintained a consisten...生意转让寻求投资合作伙伴 -

巴耶利峇

餐饮美食

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: S$13000

South Indian restaurant for takeover 30k to takeover rest is deposit,lease,rent生意转让寻求投资合作伙伴 -

实龙岗

保安保全

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

Company on dormant - with bank account生意转让寻求投资合作伙伴 -

市中心

代理经纪

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

SELLING YOUR COMPANY ? EXPANDING YOUR COMPANY ? PURCHASING A COMPANY ? OR INVESTORS SOURCING REQUIRED ? EK Consultancy is the local SMEs choice broker. Connect with us at : 68295349 or www.ekconsultancy.com.sg Offices : 1) 101 Thomson Road. United Square. #06-01/06. Singapore 307591 2) 111 Some...生意转让寻求投资合作伙伴 -

市中心

代理经纪

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

2026 New Business Listings : EK Consultancy is a professional Business Broker firm specializing in Business Sales , Expansion and Purchase for clients. Our Team of 12 consultants each specializing in their expertise fields of industries. For any Business consultation , feel free to connect with...生意转让寻求投资合作伙伴 -

市中心

广告公司

投资理财

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: S$3800

EK Consultancy : EK Consultancy is a professional business broker firm specializing in business sales , expansion and purchase for clients. Our team of 12 consultants backed up by Admin Support is equipped to assist all Clients. Our Professional Services : - Business Consultancy Business Sales ...生意转让寻求投资合作伙伴 -

宏茂桥

亚洲风味餐厅

咖啡馆

清真餐厅

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

Coffee Hive is a casual café chain that provides unpretentious good food, freshly brewed local kopi (coffee), and fast service in a cheerful, cosy space. Here, you can have a variety of Singapore-style fusion food every day, without breaking your bank. We take pride in our kopi. With only real in...生意转让寻求投资合作伙伴 -

东海岸

健身房

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: S$8500

F45 Franchise生意转让寻求投资合作伙伴 -

勿洛

家具店

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

Singapore Furniture Showroom For Sale,新加坡家具展厅转让, 现正常经营中。。。。生意转让寻求投资合作伙伴 -

市中心

宠物店

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

This is a unique cat-friendly co-working and lifestyle space located near the Bugis area, combining a relaxing work environment with a meaningful mission of supporting and rehoming cats. The space provides a calm and inspiring atmosphere where members can work alongside friendly resident cats. In ...生意转让寻求投资合作伙伴 -

兀兰

宠物店

宠物护理

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

10+ Year Established Pet Grooming & Pet Sales Business – Profitable Turnkey Opportunity An established pet grooming and pet sales business with more than 10 years of operating history located in a mature residential neighborhood in North Singapore. The business benefits from strong demand from ne...生意转让寻求投资合作伙伴 -

S$5-10万

女皇镇

亚洲风味餐厅

清真餐厅

1天前- 月营业额: S$2-5万

- 月净利润: <S$5千

- 月租金: S$8000

F&B Takeover Opportunity – Pasir Panjang Road (Ground Floor) 🔥 📍 Size: Approx. 1,200 sqft 🍽️ 40 seating capacity + Private room ❄️ Fully air-conditioned 👨🍳 Newly renovated kitchen ($50K investment) ✔ Exhaust & grease trap installed 🥢 SFA License 👥 Manpower included: * 1 S Pass * 2 NTS * ...生意转让寻求投资合作伙伴 -

S$190万(可商)

宏茂桥

生活服务

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: 一

Landscaping company,mainly tree works, some small maintainence job生意转让寻求投资合作伙伴 -

麦波申

餐饮配送

清真餐厅

1天前- 月营业额: 一

- 月净利润: 一

- 月租金: S$18500

✅ HALAL-CERTIFIED – Approved Central Halal Food License ✅ High Ceiling – Spacious and well-ventilated ✅ Fully Equipped – Cooking setup, frozen area, and dedicated cutting section ✅ Functional Layout – Includes Director’s Room & Conference Room ✅ Ideal for Business Expansion – Fresh lease, ready fo...生意转让寻求投资合作伙伴 -

实龙岗

信息技术

餐饮美食

1天前- 月营业额: S$10-20万

- 月净利润: S$1-2万

- 月租金: S$20000

Why Partner With Us? Achieve 6–8 months ROI with a concept engineered for financial efficiency. We don’t operate like traditional F&B businesses — we design ventures where capital multiplies through innovation, speed, and strategic positioning. A new-to-market dining concept with zero direct comp...生意转让寻求投资合作伙伴